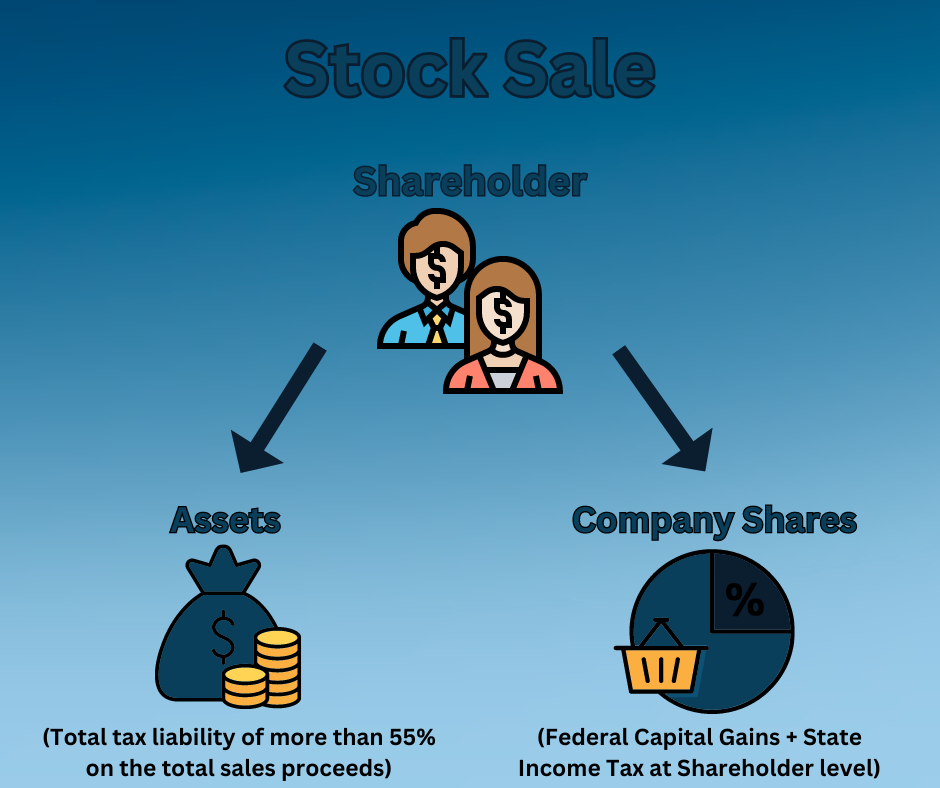

A C Corp shareholder involved in an asset sale would be well advised to look at the ramifications of double taxation at the corporate and shareholder level prior to the closing of such sale. Under an asset sale, federal and state income tax is first applied to net proceeds; the proceeds are then distributed to shareholders, who would pay a dividend tax of at least 15% plus any state income taxes on the distribution. As a result, a shareholder can end up with a total tax liability and burden of more than 55% on the total sale proceeds.

Alternatively, if there is some negotiability in the process, RR&A’s attorneys can advocate for a stock sale, which would result in payment to shareholders separate and apart from the company, subject only to federal capital gains and state income taxes on any increase in value as to the shares sold.

By involving your attorney in the preliminary tax discussions, rather than waiting until after the Letter of Intent is signed, we can mitigate your exposure to taxes by helping craft a sale that considers your unique circumstances as a shareholder under the existing corporate structure.

Andrew is a Partner at R. Reese & Associates and leads the Corporate and Transactions teams. To learn more about Andrew, visit his attorney page.

Disclaimer: The information and material on this website is general information about our practice and firm. This information does not offer specific legal advice and the use of this information does not create an attorney-client relationship with RR&A or any of its attorneys. The information on this website should not be used for legal advice, and persons should not act upon the information on this website without engaging professional legal counsel.